If you already are making a safe harbor contribution into your 401(k) plan, you may not have thought about making such contribution to the ESOP instead. If your employer contributions already total 3-4% of compensation and the 401(k) plan has problems passing the ADP and/or ACP tests, safe harbor is definitely something worthwhile to look at and consider.

SAFE HARBOR CONTRIBUTION PLUS

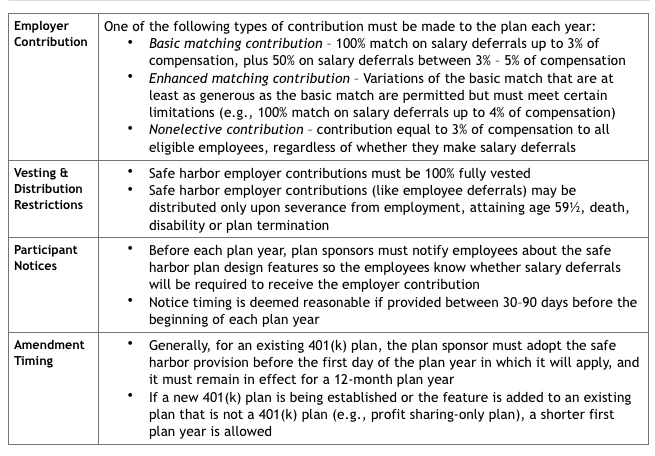

To qualify as a safe harbor plan, the employer commits to provide either (1) a matching contribution on a dollar-for-dollar basis up to 3% of compensation plus 50% of the next 2% of compensation that is deferred by the employee, or (2) a profit sharing contribution of 3% of pay or more for all participants, whether they make 401(k) contributions or not. (Note: there may be other tests that still trigger a refund.)

More importantly your highly compensated employees can contribute up to the maximum allowable dollar amount to the 401(k) plan and not worry about receiving a refund after the end of the year because these tests have been failed. If your plan qualifies as a safe harbor plan, then this testing is no longer needed. These tests are designed to limit the 401(k) deferral contributions made by, and the matching contributions made on behalf of, the highly compensated employees. Such tests are known as the average deferral percentage (ADP) test and the average contribution percentage (ACP) test. The concept of the safe harbor 401(k) plan design is to avoid the need to perform the special nondiscrimination testing applicable to 401(k) plans.

0 kommentar(er)

0 kommentar(er)